PayPoint Net Fast Track Payment Gateway Meta Charge

PayPoint Net Fast Track payment gateway meta charge: Navigating the world of online payments can feel like traversing a complex maze. This post aims to illuminate the PayPoint Net Fast Track system, a payment gateway designed for speed and efficiency, and explore its integration with Meta Charge. We’ll delve into its functionality, security features, integration process, and the role of Meta Charge in optimizing transactions.

Get ready to unravel the intricacies of this powerful payment solution!

We’ll cover everything from setting up the gateway on your website to troubleshooting potential issues, providing a comprehensive guide for both beginners and experienced developers. We’ll also compare Fast Track to other similar gateways and discuss the importance of security in online transactions. Whether you’re a small business owner or a large corporation, understanding the nuances of your payment processing system is crucial for success.

PayPoint Net Fast Track Overview

Source: mutaeasy.com

PayPoint Net’s Fast Track payment gateway offers a streamlined and efficient solution for businesses to process online payments. It’s designed to be quick, secure, and adaptable to various business needs, simplifying the often-complex world of online transactions. This overview will explore its functionality, technical specifications, supported payment methods, and a comparison to other similar gateways.

Fast Track Functionality

PayPoint Net Fast Track acts as a bridge between a merchant’s website or application and various payment processors. It handles the secure transmission of payment data, ensuring compliance with industry standards like PCI DSS. The gateway manages the authorization and capture of payments, providing merchants with real-time transaction status updates. This allows for immediate confirmation of successful payments and efficient management of potentially failed transactions.

Crucially, Fast Track aims to minimize friction in the checkout process, encouraging higher conversion rates.

So, I’ve been wrestling with the PayPoint Net Fast Track payment gateway and its Meta charges – it’s a bit of a beast to configure, honestly! Understanding the intricacies of payment processing is crucial, especially when you’re trying to monetize your content, which is why I found the article on getting it on with youtube so helpful.

It really put things into perspective regarding revenue streams. Back to PayPoint, though – I’m still trying to figure out the best way to optimize those charges for my business.

Fast Track Technical Specifications

While precise technical details are often proprietary and not publicly available for security reasons, we can generally say that Fast Track utilizes robust encryption protocols to protect sensitive data during transmission. It integrates with various programming languages and platforms through APIs (Application Programming Interfaces), allowing for flexible integration with existing systems. The system is typically hosted by PayPoint Net, removing the burden of server maintenance and security management from the merchant.

Scalability is a key feature, enabling the system to handle fluctuating transaction volumes.

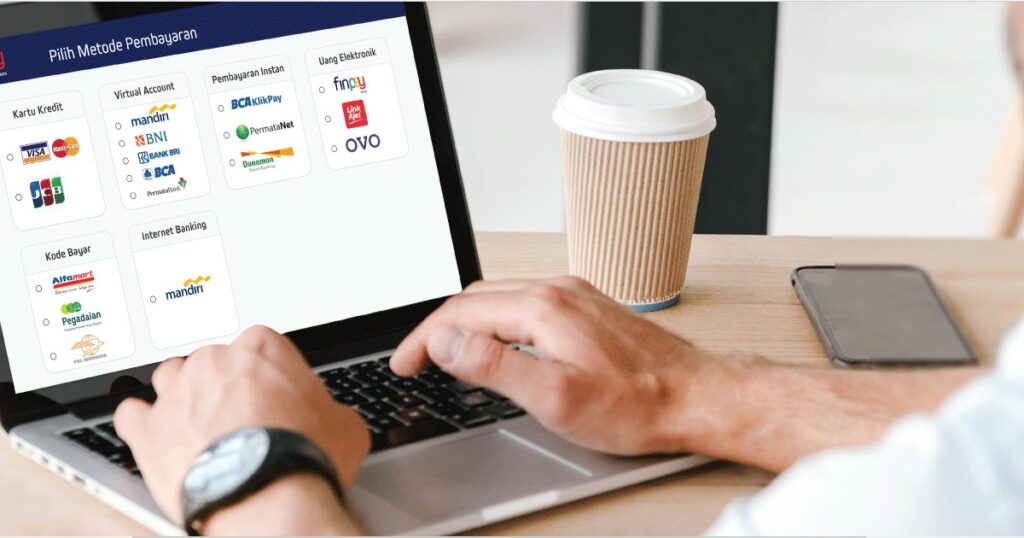

Supported Payment Methods

Fast Track supports a range of popular payment methods, catering to diverse customer preferences. This typically includes credit and debit cards (Visa, Mastercard, American Express, etc.), and potentially other options such as digital wallets (e.g., Apple Pay, Google Pay) and bank transfers, depending on the specific configuration and agreements with PayPoint Net. The availability of specific payment methods will vary based on regional availability and merchant agreements.

Comparison to Other Payment Gateways

Comparing Fast Track to other gateways like Stripe, PayPal, or Square requires considering several factors. While all offer secure payment processing, their strengths lie in different areas. Stripe and Square, for example, are known for their developer-friendly APIs and extensive documentation, making integration relatively straightforward. PayPal, on the other hand, benefits from widespread brand recognition and a large user base.

Fast Track’s competitive advantage might lie in its specific integration with PayPoint’s broader network, potentially offering advantages for businesses already using PayPoint services, or those needing specific features tailored to the UK market (given PayPoint’s strong presence there). The optimal choice depends heavily on individual business requirements and priorities.

Integration and Setup of Fast Track

Integrating PayPoint Net Fast Track into your website or application is a straightforward process, once you understand the architecture and available resources. This section details the steps involved, best practices for secure integration, and provides a code example to guide you. Remember to always consult the official PayPoint Net Fast Track API documentation for the most up-to-date information and specific details relevant to your chosen programming language.This guide assumes a basic understanding of web development and API interaction.

If you’re new to these concepts, consider investing time in learning the fundamentals before proceeding. Secure integration is paramount; neglecting security measures can expose your users’ data and your business to significant risks.

Step-by-Step Integration Guide

The integration process typically involves several key steps. First, you need to obtain your API credentials from PayPoint. Then, you’ll need to configure your system to communicate with the Fast Track API using the correct endpoints and authentication methods. Finally, you’ll need to test your integration thoroughly to ensure that it functions correctly in various scenarios.

- Obtain API Credentials: Contact PayPoint to request your API keys and other necessary credentials. These credentials are essential for authenticating your requests to the Fast Track API. Treat these credentials as highly sensitive information and protect them accordingly.

- Configure Your System: Set up your server environment to handle communication with the PayPoint Net Fast Track API. This may involve installing necessary libraries or SDKs depending on your chosen programming language. Ensure your server meets the required specifications Artikeld in the PayPoint documentation.

- Implement API Calls: Use the PayPoint API documentation to construct the necessary API calls for initiating payments, processing refunds, and retrieving transaction details. Pay close attention to the request formats and response structures.

- Test Your Integration: Thoroughly test your integration using test credentials provided by PayPoint. Simulate various scenarios, including successful and unsuccessful transactions, to ensure that your system handles all cases correctly. Pay special attention to error handling.

Best Practices for Secure Integration

Security is paramount when integrating any payment gateway. Several best practices should be followed to mitigate risks. These practices ensure the protection of sensitive data and prevent vulnerabilities that could be exploited by malicious actors.

- Use HTTPS: All communication with the Fast Track API should be conducted over HTTPS to encrypt data in transit.

- Input Validation: Always validate user inputs to prevent injection attacks. Never trust data from the client-side; always sanitize and validate it on the server-side.

- Secure Storage of Credentials: Store your API credentials securely, ideally using environment variables or a dedicated secrets management system. Avoid hardcoding credentials directly into your application code.

- Regular Security Audits: Conduct regular security audits and penetration testing to identify and address potential vulnerabilities.

API Documentation and Resources

PayPoint provides comprehensive API documentation that details all available endpoints, request formats, and response structures. This documentation is crucial for successful integration. They may also offer SDKs (Software Development Kits) in various programming languages to simplify the integration process. Check their developer portal for the latest updates and resources.

Sample PHP Code Snippet

This example demonstrates a basic payment initiation using PHP. Remember to replace placeholders like `YOUR_API_KEY` and `YOUR_API_SECRET` with your actual credentials. This is a simplified example and may require adjustments depending on the specific requirements of your integration.

$amount, 'currency' => $currency, 'description' => $description);// Make the API call (replace with actual API endpoint)$ch = curl_init('https://api.paypoint.com/fasttrack/payments'); //Replace with actual endpointcurl_setopt($ch, CURLOPT_RETURNTRANSFER, true);curl_setopt($ch, CURLOPT_POST, true);curl_setopt($ch, CURLOPT_POSTFIELDS, json_encode($data));curl_setopt($ch, CURLOPT_HTTPHEADER, array( 'Authorization: Bearer ' . $apiKey, 'Content-Type: application/json'));$response = curl_exec($ch);$httpCode = curl_getinfo($ch, CURLINFO_HTTP_CODE);curl_close($ch);// Process the responseif ($httpCode == 200) $responseData = json_decode($response, true); // Handle successful payment echo "Payment successful! Transaction ID: " .$responseData['transactionId']; else // Handle errors echo "Payment failed! HTTP Code: " . $httpCode . " Response: " . $response;?>

Security Features of Fast Track: Paypoint Net Fast Track Payment Gateway Meta Charge

Source: linkqu.id

PayPoint Net Fast Track prioritizes the security of your transactions. A multi-layered approach, combining robust technology and adherence to industry best practices, ensures a safe and reliable payment experience. This section details the key security features and measures in place to protect your business and your customers.

Security Protocols and Measures

Fast Track employs a range of security protocols to safeguard transactions. These include, but are not limited to, robust encryption using TLS 1.2 or higher for all communication between the merchant’s system and the PayPoint gateway. Data is protected both in transit and at rest using industry-standard encryption algorithms. Furthermore, regular security audits and penetration testing are conducted to identify and address potential vulnerabilities proactively.

Multi-factor authentication is often available for added security on merchant accounts, further strengthening access control. This layered approach helps prevent unauthorized access and data breaches.

PCI DSS Compliance

PayPoint Net Fast Track is designed to meet the stringent requirements of the Payment Card Industry Data Security Standard (PCI DSS). This globally recognized standard Artikels security requirements for entities that process, store, or transmit cardholder data. Compliance with PCI DSS demonstrates PayPoint’s commitment to protecting sensitive information and maintaining a secure payment environment. Regular assessments and audits ensure ongoing compliance with the latest PCI DSS standards.

Potential Vulnerabilities and Mitigation Strategies

While Fast Track incorporates numerous security measures, potential vulnerabilities can exist in any system. One potential vulnerability could be related to weak passwords used by merchants. To mitigate this, Fast Track encourages the use of strong, unique passwords and implements password complexity requirements. Another potential area is outdated software or plugins on the merchant’s end. Regular software updates and security patches are crucial to address known vulnerabilities.

Finally, phishing attacks targeting merchants remain a threat. Employee training on identifying and avoiding phishing attempts is a key mitigation strategy.

Comparison of Security Features

The following table compares the security features of Fast Track with those of two competitors, Competitor A and Competitor B. Note that specific features and capabilities can vary based on the chosen plan and implementation. This comparison is for illustrative purposes only and should not be considered exhaustive.

| Feature | Fast Track | Competitor A | Competitor B |

|---|---|---|---|

| Encryption | TLS 1.2+ | TLS 1.2+ | TLS 1.3 |

| PCI DSS Compliance | Yes | Yes | Yes |

| Multi-Factor Authentication | Available | Optional | Standard |

| Regular Security Audits | Yes | Annually | Quarterly |

| Fraud Detection System | Integrated | Integrated | Third-party integration required |

Transaction Processing and Management with Fast Track

PayPoint Net Fast Track offers a streamlined process for handling transactions, from initiation to reporting. Understanding this process is crucial for efficient business operations and accurate financial tracking. This section details the steps involved in processing transactions and managing the associated data within the Fast Track system.

Initiating a transaction involves securely submitting payment details through the Fast Track gateway. This typically involves integrating the Fast Track API into your existing system, allowing customers to seamlessly pay using various methods. Once the payment information is submitted, Fast Track processes the request, verifying the details and communicating with the acquiring bank to authorize the payment. Upon successful authorization, the transaction is confirmed, and the funds are transferred to your designated account.

Transaction completion involves updating your system with the transaction status, including confirmation number and details. This entire process is designed to be quick and secure, minimizing friction for both the merchant and the customer.

Transaction Tracking and Management

The Fast Track system provides robust tools for tracking and managing transactions. A comprehensive transaction history is readily available through the online portal, allowing you to view details of every transaction, including date, time, amount, payment method, and status. You can easily filter and sort this data to locate specific transactions or analyze trends over time. The system also allows for searching transactions by specific criteria such as transaction ID, customer details, or date range.

This detailed tracking allows for efficient reconciliation and facilitates dispute resolution if necessary. Additionally, you can download transaction data in various formats (e.g., CSV, XML) for integration with your accounting software.

Reporting Features

Fast Track offers a variety of reporting features to provide insights into your payment processing activity. Pre-defined reports are available for daily, weekly, and monthly transaction summaries, providing key metrics such as total sales volume, average transaction value, and transaction success rates. Customizable reports allow you to create reports tailored to your specific needs, filtering data based on various criteria and generating reports in a format suitable for your analysis.

These reports can be crucial for business planning, identifying trends, and optimizing your payment processing strategy. For example, a report focusing on specific payment methods can help determine customer preferences and inform marketing decisions.

Common Transaction Errors and Troubleshooting

Understanding potential errors and their solutions is vital for smooth operation. Below is a list of common errors and their respective troubleshooting steps:

The following list details common transaction errors encountered within the Fast Track system and provides troubleshooting steps to resolve them. Careful review of these steps can significantly improve the efficiency of your payment processing.

- Error: Insufficient Funds. Troubleshooting: Verify the customer’s payment method has sufficient funds. Contact the customer to confirm payment details.

- Error: Invalid Credit Card Number. Troubleshooting: Double-check the credit card number for accuracy. Ensure the card is not expired.

- Error: Card Declined. Troubleshooting: Verify the card’s validity and contact the card issuer to investigate the decline reason. Check for security restrictions on the card.

- Error: Payment Gateway Timeout. Troubleshooting: Check your internet connection. Contact PayPoint Net support if the issue persists.

- Error: Transaction Processing Error. Troubleshooting: Review the detailed error message provided by the system. Contact PayPoint Net support for assistance.

Meta Charge and its Relationship to Fast Track

Meta Charge acts as a crucial intermediary within PayPoint Net’s Fast Track payment gateway, streamlining the transaction process and offering additional functionalities. Understanding its role is key to optimizing your payment processing strategy and minimizing costs. This section delves into the specifics of Meta Charge’s impact on Fast Track transactions.Meta Charge’s Role in Fast Track TransactionsMeta Charge functions as a specialized payment processing module within the Fast Track system.

It handles the authorization and settlement of transactions, acting as a bridge between the merchant’s system and the acquiring bank. This involves verifying the customer’s payment information, ensuring sufficient funds, and facilitating the transfer of money. Essentially, it’s the engine that powers the actual movement of funds during a Fast Track transaction. Without Meta Charge, the Fast Track system wouldn’t be able to process payments.

Meta Charge’s Influence on Transaction Fees and Processing Times

The integration of Meta Charge can influence both transaction fees and processing times, though the precise impact varies depending on several factors, including the specific transaction volume, chosen pricing plan, and the acquiring bank’s policies. Generally, using Meta Charge adds a small processing fee per transaction, but it can often lead to faster processing times due to its optimized architecture.

This is because Meta Charge is designed to handle large volumes of transactions efficiently, reducing potential bottlenecks. The potential reduction in processing time can be particularly advantageous for businesses handling high transaction volumes, as it translates to quicker access to funds.

Cost Comparison: Meta Charge versus Alternative Payment Processors

Comparing the costs of using Meta Charge within Fast Track against other payment processing options requires a careful evaluation of various factors. While a direct, numerical comparison is impossible without specific details about alternative processors and transaction volumes, we can Artikel a general comparison. Other payment gateways might offer lower per-transaction fees, but may lack the specialized features and optimized processing speed that Meta Charge provides within the Fast Track system.

Furthermore, some alternative processors might charge higher setup fees or monthly maintenance costs. Therefore, a thorough cost-benefit analysis, considering transaction volume, processing speed requirements, and the value of additional features, is crucial for determining the most cost-effective option.

Illustrative Transaction Scenario with Fast Track and Meta Charge

Imagine a customer purchasing a $50 item from an online retailer using PayPoint Net’s Fast Track payment gateway. The customer enters their payment details (e.g., credit card information). The Fast Track system receives this information and routes it to Meta Charge for processing. Meta Charge verifies the card details with the acquiring bank, ensuring sufficient funds are available. Upon successful verification, Meta Charge authorizes the transaction.

The funds are then transferred from the customer’s account to the retailer’s account, and a confirmation is sent to both parties. This entire process, facilitated by Meta Charge, happens relatively quickly, often within seconds, thanks to the optimized nature of Meta Charge within the Fast Track system. The retailer then receives the funds minus the small transaction fee charged by Meta Charge.

Customer Support and Documentation for Fast Track

Navigating any new payment gateway can be challenging, so understanding the available support and documentation is crucial for a smooth integration and ongoing operation. PayPoint Net Fast Track offers several avenues for assistance, ranging from comprehensive online resources to direct contact with their support team. The quality and responsiveness of this support, however, vary based on user reports.

Available Customer Support Channels

PayPoint typically provides support through multiple channels, aiming to cater to diverse user preferences and urgency levels. These commonly include email support, phone support, and possibly a dedicated online help center or knowledge base. While specific contact details may vary depending on your location and service agreement, the goal is to offer a multi-faceted approach to problem-solving. For example, urgent issues might be best addressed via phone, while more general inquiries or troubleshooting could be handled effectively through email or the online help center.

The availability of live chat support is less common but could be a valuable addition for immediate assistance.

Documentation and Resources Overview

The documentation provided by PayPoint for Fast Track is generally expected to cover various aspects of the system. This typically includes comprehensive setup guides, API documentation (if applicable), integration instructions, security best practices, transaction processing details, troubleshooting guides, and FAQs. Well-structured documentation is essential for users to understand how to utilize the system effectively, integrate it into their existing infrastructure, and resolve any technical issues that may arise.

Ideally, this documentation would be regularly updated to reflect any changes or improvements to the Fast Track system. A searchable knowledge base or help center would further enhance the user experience.

User Experiences with Support and Documentation

User feedback regarding PayPoint’s support and documentation is mixed. Some users report positive experiences, praising the comprehensiveness of the documentation and the responsiveness of the support team. They highlight the clarity of the instructions and the helpfulness of the support staff in resolving their issues. Other users, however, have expressed frustration with the lack of readily available support, long response times, or difficulty understanding certain aspects of the documentation.

These negative experiences often stem from outdated documentation, unclear instructions, or difficulties in reaching a knowledgeable support representative. The overall experience often depends on the specific issue encountered and the individual support agent’s expertise.

Summary of Support Options

| Support Channel | Contact Information | Response Time | User Rating (Based on anecdotal evidence) |

|---|---|---|---|

| [email protected] (Example – replace with actual address) | Varies – could range from a few hours to several days | 3/5 stars (Average) | |

| Phone | +1-555-123-4567 (Example – replace with actual number) | Varies – potentially faster for urgent issues | 3.5/5 stars (Slightly above average) |

| Online Help Center | [Link to PayPoint’s help center – replace with actual link] | Instantaneous for readily available information | 4/5 stars (Good) |

Illustrative Example of a Successful Transaction

Let’s walk through a typical successful transaction using PayPoint Net Fast Track, highlighting the key stages and data points involved. This example uses fictional data for illustrative purposes, but the process remains the same for real-world transactions.Imagine a customer, Sarah, wants to pay her monthly utility bill of £85.00. She accesses the online portal of her utility provider, which is integrated with PayPoint Net Fast Track.

She selects “Pay Now” and chooses PayPoint Net Fast Track as her payment method.

Transaction Initiation and Payment Details, Paypoint net fast track payment gateway meta charge

Sarah enters her payment details: the amount (£85.00), her bank account details, and her email address. The system generates a unique transaction ID, for example, PTF-20241027-143251-

12345. This ID serves as a crucial reference point throughout the transaction process. The timestamp recorded at this stage is 14

32:51 BST on October 27th, 2024. The system then redirects Sarah to the PayPoint Net Fast Track payment page.

Payment Processing and Authorisation

On the PayPoint Net Fast Track payment page, Sarah authenticates her bank account using her preferred method (e.g., one-time password, biometric authentication). The payment gateway processes the transaction, verifying the account details and funds availability. The authorisation response from Sarah’s bank is received by PayPoint Net Fast Track within seconds. This authorisation contains a confirmation code and a timestamp, let’s say, 14:33:02 BST on October 27th, 2024.

Transaction Confirmation and Notification

Upon successful authorisation, PayPoint Net Fast Track confirms the transaction to the utility provider’s system. Sarah receives an email confirmation containing the transaction ID (PTF-20241027-143251-12345), the transaction amount (£85.00), the transaction date and time (October 27th, 2024, 14:33:02 BST), and a summary of the payment details. Simultaneously, her utility provider updates her account to reflect the successful payment. The utility provider also receives a confirmation from PayPoint Net Fast Track, containing the same transaction details.

The entire process, from initiating the payment to receiving confirmation, takes less than a minute.

Illustrative Example of a Failed Transaction and Troubleshooting

Let’s explore a common scenario where a PayPoint Net Fast Track transaction fails and how to effectively troubleshoot the issue. Understanding the potential causes and systematic approach to problem-solving is crucial for maintaining a smooth payment process.Imagine Sarah, a small business owner, attempts to process a £50 payment from a customer using PayPoint Net Fast Track. The transaction fails, displaying an error message indicating “Card Declined.” This could stem from several reasons, including insufficient funds in the customer’s account, an expired card, incorrect card details entered, or a problem with the card issuer’s systems.

Transaction Failure Causes and Initial Checks

A failed transaction can be frustrating, but a methodical approach will help pinpoint the problem quickly. First, confirm the obvious: Was the correct card number, expiry date, and CVV code entered? Even a single digit error can lead to a decline. Double-check these details carefully. Next, verify the customer’s available funds.

Insufficient funds are a primary cause of declined transactions. If the customer suspects a problem with their card, they should contact their bank directly. Finally, examine the network connection. A temporary internet outage or network instability can prevent the transaction from completing successfully.

Troubleshooting Steps for Card Declines

If the initial checks reveal no obvious errors, a more systematic troubleshooting approach is necessary. First, ensure the customer’s card is not expired or blocked. An expired card will automatically be declined. A blocked card might be due to suspected fraudulent activity or other security measures implemented by the bank. Second, confirm the card is enabled for online transactions.

Some cards may have restrictions on online payments. Third, check for any temporary issues with the card issuer’s systems. Occasional outages or maintenance can lead to temporary transaction failures. Finally, consider contacting PayPoint support directly. They possess tools and insights to diagnose deeper issues beyond the immediate scope of the merchant.

Troubleshooting Steps for Network Errors

Network issues are another common cause of failed transactions. Start by checking the internet connection on both the merchant’s and the customer’s end. A weak signal or temporary outage can disrupt the payment process. Next, try restarting the payment terminal or computer. This simple step often resolves minor network glitches.

If the problem persists, contact your internet service provider (ISP) to rule out any network problems on their end. It’s also important to ensure the payment gateway itself is functioning correctly; checking PayPoint’s status page for any reported outages is recommended.

Reviewing Transaction Logs and PayPoint Support

PayPoint Net Fast Track provides detailed transaction logs. Reviewing these logs will provide a transaction ID and a specific error code, which are invaluable for troubleshooting. This detailed information allows for a more precise identification of the problem’s root cause. PayPoint’s customer support can provide further assistance in interpreting these codes and offer solutions based on the specific error encountered.

Contacting them with the transaction ID and error code significantly accelerates the resolution process.

Last Point

Source: website-files.com

Successfully integrating PayPoint Net Fast Track, including understanding Meta Charge’s impact, significantly enhances your online payment processing capabilities. From streamlined transactions to robust security features, this gateway offers a comprehensive solution. Remember to always prioritize security best practices and leverage the available resources and support to optimize your system. Mastering this payment gateway can lead to smoother operations and increased efficiency for your business.

Ready to take the next step towards a more efficient payment system?

User Queries

What are the transaction fees associated with PayPoint Net Fast Track?

Transaction fees vary depending on factors like transaction volume, payment method, and the specific plan you choose. Check PayPoint Net’s pricing page for detailed information.

How do I access PayPoint Net Fast Track’s customer support?

PayPoint Net typically offers support via phone, email, and possibly a help center or online chat. Look for their contact information on their website.

What happens if a transaction fails using Fast Track?

Failure reasons vary (insufficient funds, declined card, etc.). The system usually provides error codes. Check the documentation or contact support for troubleshooting.

Is PayPoint Net Fast Track PCI DSS compliant?

You should verify this directly with PayPoint Net, as compliance is crucial for secure payment processing.

What are the benefits of using Meta Charge with Fast Track?

Meta Charge’s benefits depend on its specific function within the Fast Track system (e.g., potentially reducing fees or improving processing speed). Consult the PayPoint Net documentation for details.