SagePay Update New Protocol v3.0

Sagepay update new protocol v3 0 – SagePay update new protocol v3.0 is here, and it’s a game-changer! This upgrade promises significant improvements in security, efficiency, and overall payment processing. Get ready to dive into the details of this exciting new release, from its enhanced security features to the streamlined integration process. We’ll cover everything you need to know to smoothly transition to the latest version and reap its benefits.

This post will explore the key features of SagePay’s Protocol v3.0, detailing the integration process, security enhancements, API usage, and best practices for a seamless transition. We’ll also address common challenges and provide solutions to help you navigate this update with confidence. Whether you’re a seasoned developer or just getting started with SagePay, this guide is your go-to resource.

Sage Pay Protocol v3.0 Overview

Sage Pay Protocol v3.0 represents a significant advancement in online payment processing, offering enhanced security, improved functionality, and a more streamlined integration process for merchants. This upgrade builds upon the strengths of previous versions while addressing evolving industry standards and security best practices. It’s a crucial update for businesses looking to optimize their payment gateway and ensure a secure and efficient checkout experience for their customers.

Key Features and Functionalities of Sage Pay Protocol v3.0

Sage Pay Protocol v3.0 boasts several key features designed to improve the overall payment processing experience. These include enhanced support for various payment methods, improved error handling and reporting, and a more robust API for seamless integration with existing systems. The protocol also facilitates a smoother customer journey, leading to higher conversion rates and reduced cart abandonment. Specific functionalities include improved support for recurring payments and advanced fraud prevention tools.

Improvements and Enhancements Compared to Previous Versions

Version 3.0 offers substantial improvements over its predecessors, primarily focusing on security and efficiency. The most noticeable enhancement is the strengthened security measures, designed to protect both the merchant and the customer from fraudulent activities. The updated protocol also streamlines the integration process, reducing development time and complexity for merchants. Further improvements include more detailed transaction reporting and improved error handling, simplifying troubleshooting and maintenance.

This leads to a more reliable and efficient payment processing system.

Security Measures Implemented in v3.0

Security is paramount in online payment processing, and Sage Pay v3.0 reflects this commitment. The protocol incorporates advanced encryption techniques, ensuring that sensitive data remains protected throughout the transaction process. This includes the use of stronger encryption algorithms and enhanced authentication protocols. Furthermore, v3.0 integrates with various fraud prevention tools and services, providing an additional layer of protection against fraudulent transactions.

Regular security audits and updates further ensure the ongoing security of the system.

Comparison of Sage Pay Protocol v3.0 and v2.0

The following table highlights the key differences between Sage Pay Protocol v3.0 and v2.0:

| Feature | v2.0 | v3.0 |

|---|---|---|

| Encryption | Older encryption standards | Stronger, more modern encryption algorithms (e.g., AES-256) |

| API | Less robust and flexible API | Improved and more extensive API for easier integration |

| Fraud Prevention | Basic fraud detection features | Integrated advanced fraud prevention tools and services |

| Error Handling | Less detailed error reporting | Improved and more informative error reporting |

Integration Process and Requirements

Integrating Sage Pay Protocol v3.0 into your e-commerce platform requires a methodical approach, encompassing both server-side and client-side development. This process involves setting up your Sage Pay account, configuring your platform to communicate with the Sage Pay API, and thoroughly testing the integration to ensure seamless transactions. Understanding the requirements and potential challenges beforehand is crucial for a smooth implementation.

The integration process broadly involves setting up your Sage Pay account, configuring the necessary API credentials, and implementing the payment gateway functionality within your e-commerce application. This involves handling requests and responses, managing security aspects, and correctly interpreting the various transaction statuses returned by Sage Pay. Careful attention to detail throughout the process is vital for a successful integration.

Server-Side Components and Setup

Successful integration relies heavily on your server-side infrastructure. You’ll need a server capable of handling HTTPS requests and responses, a suitable programming language (such as PHP, Python, Node.js, etc.) with libraries supporting RESTful API interactions, and a secure environment to store your Sage Pay API credentials. These credentials, including your vendor name, password, and integration type, are critical for authentication and authorization with the Sage Pay system.

Failing to secure these can lead to significant security vulnerabilities. The server should also be configured to handle webhooks, which Sage Pay uses to send real-time transaction updates.

Client-Side Integration and User Experience

The client-side integration focuses on providing a seamless checkout experience for your customers. This involves securely collecting customer payment information (without storing sensitive data on your servers) and initiating the payment process via the Sage Pay API. The client-side primarily handles user interface elements like forms for payment details and displays transaction status messages. JavaScript frameworks like React, Angular, or Vue.js can streamline the development process, enabling a more dynamic and responsive checkout experience.

It is crucial to ensure the client-side code properly handles errors and provides clear feedback to the user.

Step-by-Step Integration Guide

- Obtain Sage Pay Credentials: Log into your Sage Pay account and obtain your vendor name, password, and integration type. Securely store these credentials; never hardcode them directly into your application code.

- Set up Webhooks: Configure webhooks in your Sage Pay account to receive real-time notifications about transaction status changes. This enables you to automatically update your order status in your system.

- Implement Server-Side API Calls: Use your chosen programming language and libraries to make API calls to Sage Pay. This involves sending payment requests and processing responses. Implement robust error handling to manage various scenarios, including declined payments and network issues.

- Develop Client-Side Payment Form: Create a secure payment form that collects necessary customer information (name, address, card details). Use appropriate encryption methods to protect sensitive data during transmission. Avoid storing any sensitive data on your servers.

- Test Thoroughly: Test your integration extensively with different scenarios, including successful transactions, declined transactions, and error conditions. Use the Sage Pay sandbox environment for testing before deploying to production.

Code Example (Pseudo-code)

This pseudo-code illustrates a simplified server-side payment request:

// Prepare request data$request_data = array( 'vendor' => 'YOUR_VENDOR_NAME', 'password' => 'YOUR_PASSWORD', 'amount' => 1000, // Amount in pence // ... other parameters);// Make API call$response = makeApiRequest('https://www.sagepay.com/gateway/service/v3/payment', $request_data);// Process responseif ($response['status'] == 'OK') // Payment successful else // Handle payment failure

Common Integration Challenges and Solutions, Sagepay update new protocol v3 0

Several challenges commonly arise during Sage Pay integration. Understanding these beforehand can help prevent delays and frustration.

| Challenge | Solution |

|---|---|

| Incorrect API Credentials | Double-check your vendor name, password, and other credentials for accuracy. Ensure they are correctly configured in your code. |

| Network Connectivity Issues | Implement robust error handling and retry mechanisms to manage temporary network outages. Monitor your server’s network connection. |

| Security Vulnerabilities | Use HTTPS for all communication with Sage Pay. Avoid storing sensitive data on your servers. Regularly update your server software and libraries. |

| Transaction Declines | Carefully review the error messages returned by Sage Pay to understand the reason for the decline. This might involve insufficient funds, invalid card details, or other issues. |

Security Implications and Best Practices

Sage Pay Protocol v3.0 represents a significant upgrade, addressing several security vulnerabilities present in previous versions. This improved protocol enhances the protection of sensitive data during online transactions, offering a more robust and secure payment processing experience for both merchants and customers. Understanding these improvements and implementing best practices is crucial for maximizing the security benefits of the upgrade.Sage Pay Protocol v3.0 significantly enhances security by incorporating advanced encryption techniques and robust authentication mechanisms.

Previous versions may have been susceptible to certain attacks, such as man-in-the-middle attacks or replay attacks. Version 3.0 mitigates these risks through improved cryptographic algorithms and enhanced validation processes. The updated protocol also addresses vulnerabilities related to data handling and storage, offering better protection against data breaches and unauthorized access. This section will delve into specific security improvements and best practices for implementing the new protocol.

Vulnerabilities Addressed in v3.0

Sage Pay Protocol v3.0 directly addresses several key vulnerabilities found in prior versions. These vulnerabilities primarily revolved around weaknesses in encryption, authentication, and data handling. For example, previous versions may have relied on less robust encryption algorithms that are now considered outdated and vulnerable to modern cracking techniques. v3.0 replaces these with stronger, more current encryption standards, offering significantly improved protection against unauthorized decryption.

Similarly, authentication mechanisms have been strengthened to prevent unauthorized access and mitigate the risk of replay attacks. The enhanced protocol also incorporates stricter validation checks to ensure data integrity and prevent malicious manipulation of transaction data. These improvements provide a more secure foundation for online payments.

Secure Payment Gateway Architecture

A secure payment gateway architecture incorporating Sage Pay Protocol v3.0 should adhere to several key principles. First, all communication between the merchant’s website and the Sage Pay servers should be conducted over HTTPS using TLS 1.2 or higher. This ensures data encryption in transit. Second, the merchant’s server should never store sensitive customer data, such as credit card numbers or CVV codes.

Instead, the payment data should be directly transmitted to Sage Pay using the v3.0 protocol. Third, strong server-side validation should be implemented to verify the integrity and authenticity of all incoming requests from Sage Pay. This helps prevent replay attacks and ensures that transactions are legitimate. Finally, regular security audits and penetration testing should be performed to identify and address any potential vulnerabilities.

A well-designed architecture will also incorporate robust logging and monitoring to detect and respond to suspicious activity. This layered approach minimizes the risk of security breaches.

Best Practices for Handling Sensitive Data

Handling sensitive data during transactions requires strict adherence to best practices. All sensitive data, including credit card numbers, CVV codes, and personal information, should be treated as confidential and protected according to industry standards such as PCI DSS. This includes using strong encryption both in transit and at rest. Data should never be stored longer than necessary, and access to sensitive data should be restricted to authorized personnel only.

Regular security training for staff is essential to ensure that everyone understands their responsibilities in protecting sensitive information. Furthermore, implementing robust error handling and logging mechanisms can help identify and address potential data breaches quickly. Employing data loss prevention (DLP) tools can further enhance the security posture. These measures ensure the privacy and security of customer data throughout the payment process.

Security Recommendations for Developers

Implementing Sage Pay Protocol v3.0 requires careful consideration of security best practices. A list of key recommendations for developers includes:

- Validate all inputs rigorously to prevent injection attacks.

- Use strong encryption algorithms and secure key management practices.

- Implement robust error handling and logging to detect and respond to security incidents.

- Regularly update libraries and software to patch known vulnerabilities.

- Follow PCI DSS standards and guidelines for handling sensitive data.

- Conduct regular security audits and penetration testing to identify and address weaknesses.

- Use a secure web server configuration with appropriate security headers.

- Employ input sanitization techniques to prevent cross-site scripting (XSS) attacks.

Adhering to these recommendations will significantly reduce the risk of security vulnerabilities and ensure a secure implementation of Sage Pay Protocol v3.0. Remember that security is an ongoing process requiring continuous monitoring and improvement.

API Documentation and Usage

Sage Pay Protocol v3.0 provides a comprehensive set of APIs for seamless integration into your payment processing systems. Understanding the API documentation is crucial for successful implementation. This section details the key aspects of using the Sage Pay v3.0 APIs, including endpoint usage, request/response examples, error handling, and a visual representation of the typical payment transaction flow.

API Endpoints and Their Functions

The Sage Pay v3.0 API utilizes RESTful principles, offering various endpoints for different payment-related operations. These endpoints are typically accessed via HTTPS requests, and each endpoint has specific functionalities. For instance, there are endpoints for creating payment transactions, retrieving transaction details, managing refunds, and more. The specific endpoints and their functionalities are comprehensively documented in the official Sage Pay API reference.

This documentation details the HTTP methods (GET, POST, PUT, DELETE) supported by each endpoint, the required parameters, and the expected response formats (JSON or XML).

Example API Request and Response (JSON)

A typical payment transaction might involve a POST request to the `/transactions` endpoint. Below is an example of a JSON request: "vendorTxCode": "12345", "amount": 1000, "currency": "GBP", "description": "Test Transaction", "customerEmail": "[email protected]", // ... other parametersA successful response would return a JSON object containing the transaction status, transaction ID, and other relevant details. For example: "status": "Success", "transactionId": "ABCDEF123456", "securityKey": "securekeyvalue", // ... other details

Error Handling and Exception Management

The Sage Pay API uses standard HTTP status codes to indicate the success or failure of an API call. A 2xx status code indicates success, while a 4xx or 5xx code indicates an error. The response body typically contains detailed error messages, helping developers pinpoint the issue. Robust error handling is essential; developers should implement mechanisms to catch exceptions, log errors, and handle different error scenarios gracefully.

For example, a 400 Bad Request might indicate invalid input parameters, while a 500 Internal Server Error suggests a problem on the Sage Pay side.

API Call Flow for a Typical Payment Transaction

The following flowchart illustrates the API call flow for a typical payment transaction:[Diagram description: The flowchart starts with “Initiate Payment Request.” An arrow points to “Send API Request to Sage Pay (POST /transactions).” Another arrow leads to “Sage Pay Processes Request.” This branches into two paths: “Success: Return Transaction ID and Status (2xx)” and “Failure: Return Error Code and Message (4xx or 5xx).” The “Success” path leads to “Display Transaction Confirmation.” The “Failure” path leads to “Handle Error and Display Appropriate Message to User.” Both paths eventually lead to “End.”]

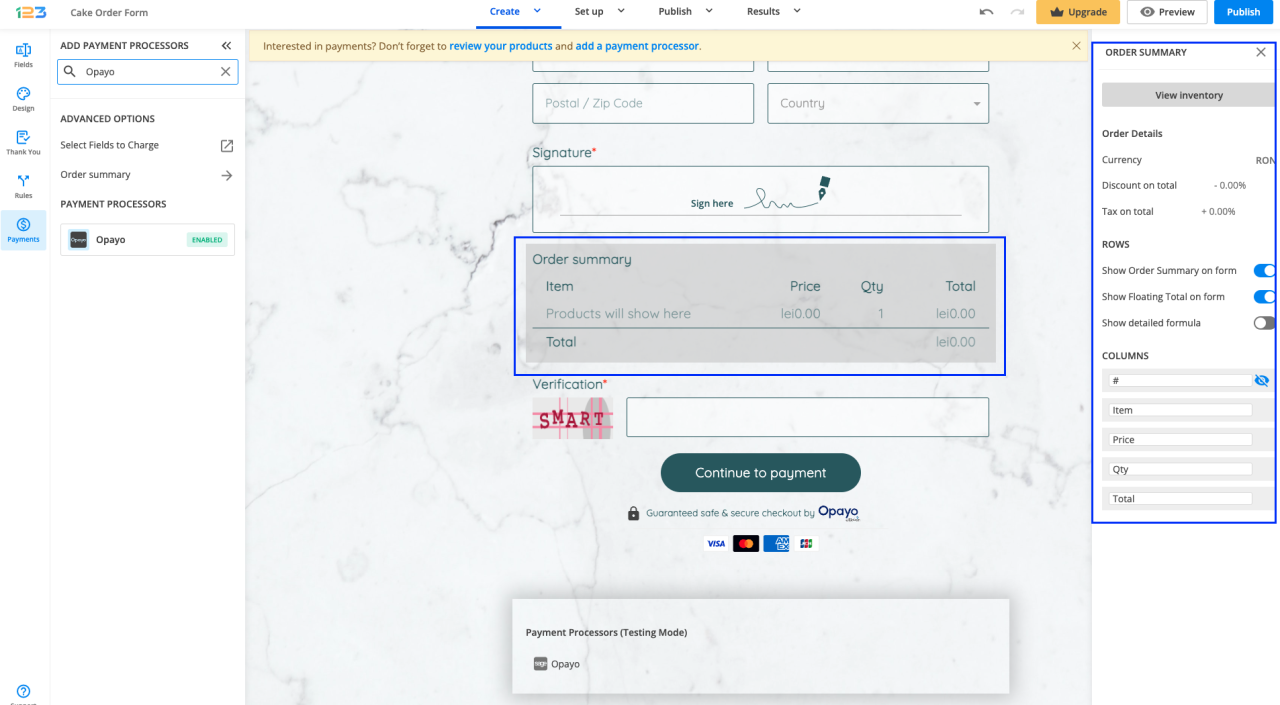

Transaction Processing and Management

Source: 123formbuilder.com

Sage Pay Protocol v3.0 offers a robust and streamlined approach to transaction processing and management. Understanding its features is crucial for efficient online payment processing and minimizing potential issues. This section details the process from initiating a payment to managing transactions and accessing reports.Sage Pay Protocol v3.0’s transaction process involves several key stages. First, you initiate a payment request by sending a properly formatted request to the Sage Pay server.

This request contains all the necessary details about the transaction, including the amount, customer information, and your vendor details. The Sage Pay server then processes the request, communicating with the payment gateway to authorize the transaction. If authorized, the server returns a response confirming the transaction and providing a transaction ID. Finally, you can then manage the transaction through the Sage Pay interface or via the API, depending on your integration method.

Initiating, Processing, and Completing Payments

The initiation of a payment involves constructing a properly formatted XML request according to the v3.0 specification. This request includes crucial data points such as the transaction amount, currency, customer details (name, address, email), and your vendor’s unique credentials. Upon sending this request, Sage Pay processes it, interacting with the customer’s payment provider. A successful authorization results in a positive response with a unique transaction ID.

This ID is crucial for tracking and managing the transaction throughout its lifecycle. The completion stage involves capturing the authorized payment, which moves the funds from the customer’s account to your merchant account. This is typically a separate step after the authorization. Failure to capture the authorized payment within a specified timeframe might lead to the authorization expiring.

Handling Transaction Failures and Refunds

Transaction failures can stem from various reasons, including insufficient funds, invalid card details, or network issues. Sage Pay provides detailed error codes in its response messages to help pinpoint the cause. These codes allow developers to implement appropriate error handling and inform the customer about the failure. Refunds are processed through the Sage Pay interface or API, requiring the transaction ID and the amount to be refunded.

The process is similar to initiating a payment, but with specific refund parameters included in the request. Sage Pay then processes the refund, crediting the customer’s account and updating the transaction status accordingly.

Transaction Tracking and Management

Sage Pay provides comprehensive tools for tracking and managing transactions. The online interface allows you to view transaction history, search for specific transactions using various criteria (e.g., date range, transaction ID, customer details), and download reports. This interface provides a visual overview of transaction statuses (e.g., authorized, captured, refunded, failed). Furthermore, the Sage Pay API offers programmatic access to transaction details, enabling automated monitoring and management within your application.

This allows for real-time tracking and integration with your internal systems for reporting and reconciliation purposes.

Accessing Transaction Details and Reports

The Sage Pay interface provides a user-friendly dashboard to access detailed transaction information. Each transaction is listed with key details such as the transaction ID, amount, date, status, and customer information. You can click on individual transactions to view even more detailed information, including any associated error messages. Reports can be generated to summarize transactions over various periods and filter them based on different criteria.

These reports are invaluable for financial reconciliation, analyzing sales trends, and identifying potential issues. The API offers equivalent functionality for programmatic access to this data, allowing for custom reporting and integration with other business intelligence tools.

The SagePay update to protocol v3.0 has been a bit of a headache, requiring some serious backend adjustments. Honestly, I needed a break from all the coding, so I checked out this awesome guide on getting it on with youtube to clear my head. After a much-needed YouTube binge, I felt refreshed and ready to tackle the remaining SagePay integration issues.

Hopefully, this new protocol will improve security and payment processing!

Testing and Debugging

Successfully integrating Sage Pay Protocol v3.0 requires a robust testing strategy to ensure seamless payment processing and minimize potential issues in a live environment. Thorough testing identifies and resolves bugs before they impact your customers, safeguarding your business reputation and financial stability. This section Artikels a comprehensive approach to testing and debugging your Sage Pay integration.

A multi-stage testing approach is crucial, starting with unit tests focusing on individual components and progressing to integration and end-to-end tests encompassing the entire payment flow. This phased approach helps isolate problems and speeds up the debugging process.

Test Environment Setup

Setting up a dedicated test environment mirrors your production environment as closely as possible. This includes using a test Sage Pay account and replicating your database structure and application configurations. This ensures that your testing accurately reflects real-world conditions and avoids unexpected behavior in the production environment. Discrepancies between test and production environments are a frequent source of integration errors.

For example, differences in database versions or server configurations can lead to unexpected results. Using a dedicated test environment isolates testing from production data and prevents accidental disruption of live operations.

Unit Testing

Unit tests verify individual components of your integration, such as the functions responsible for generating requests and processing responses from the Sage Pay API. These tests should cover various scenarios, including successful transactions, failed transactions (due to insufficient funds, invalid card details, etc.), and error handling. Employing a unit testing framework, like PHPUnit for PHP or JUnit for Java, provides a structured approach to writing, running, and managing these tests.

Example unit tests might cover validating the correct format of the request XML, handling different HTTP response codes, and correctly mapping Sage Pay responses to your application’s data structures.

Integration Testing

Integration tests focus on the interaction between different components of your system. This involves testing the complete flow of a payment transaction, from the customer initiating a payment to the confirmation of the transaction status. These tests should cover all payment methods supported by your integration and different transaction types (e.g., authorizations, captures, refunds). A common integration testing technique involves using a test payment gateway simulator that mimics the Sage Pay API’s behavior.

This allows you to test your integration without incurring real transaction costs. The simulator would be configured to return predefined responses, allowing you to test various scenarios, including errors and edge cases.

End-to-End Testing

End-to-end tests simulate the complete user journey, from the customer’s perspective, through the entire payment process. This involves testing the entire system, including your application’s user interface, the integration with Sage Pay, and any other related systems. These tests should be performed using realistic test data, including various card types, amounts, and customer details. This phase involves user acceptance testing (UAT) with real users to ensure the system meets business requirements and is user-friendly.

A key aspect is verifying that the entire transaction lifecycle is properly handled, from order placement to payment confirmation and any subsequent actions like refunds or voiding transactions.

Debugging Tools and Techniques

Effective debugging requires utilizing appropriate tools and techniques. Network monitoring tools like Wireshark or browser developer tools can be used to inspect HTTP requests and responses between your application and the Sage Pay API. This helps identify problems with request formatting, response parsing, or network connectivity. Log files are invaluable for tracking the flow of transactions and identifying potential errors.

Detailed logging of requests, responses, and internal application states aids in pinpointing the source of problems. Furthermore, debugging tools within your chosen programming language or integrated development environment (IDE) allow for step-by-step execution of code and inspection of variable values, assisting in isolating problematic sections of code.

Testing Checklist

Before launching your Sage Pay integration into a production environment, a thorough testing checklist is crucial. This checklist should cover all aspects of the integration, including:

- Successful transactions with various card types and amounts.

- Handling of failed transactions (e.g., declined cards, insufficient funds).

- Testing of different transaction types (authorizations, captures, refunds, voids).

- Verification of correct error handling and reporting.

- Testing of different currencies if applicable.

- Security testing to ensure compliance with PCI DSS standards.

- Performance testing under various load conditions.

- End-to-end testing from a user’s perspective.

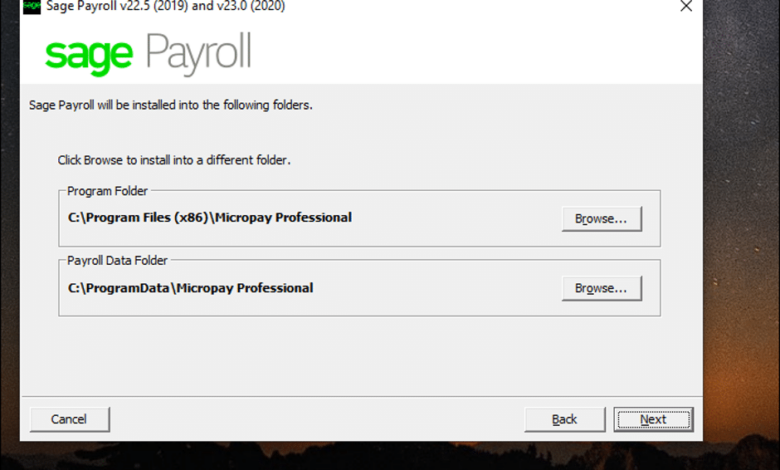

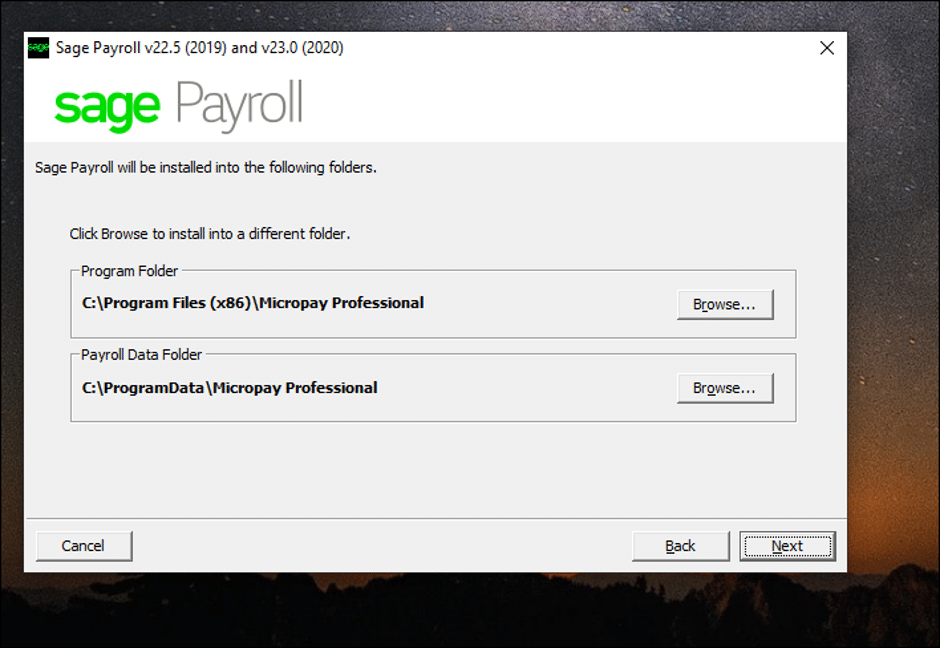

Merchant Account Setup and Configuration: Sagepay Update New Protocol V3 0

Source: webasyst.com

Setting up your merchant account and configuring Sage Pay Protocol v3.0 is crucial for seamless payment processing. This involves several steps, from initial application to fine-tuning your gateway settings for optimal performance. Understanding these processes ensures a smooth integration and minimizes potential issues.

The process begins with submitting an application to become a Sage Pay merchant. This typically involves providing business information, banking details, and confirming your identity. Sage Pay will review your application and, upon approval, provide you with the necessary credentials to access your merchant control panel. This panel is your central hub for managing all aspects of your Sage Pay integration.

Merchant Account Application Process

The application process usually involves completing an online form providing details such as your business name, address, contact information, and bank account details. You’ll also need to provide documentation to verify your business identity and legitimacy. Sage Pay will then review your application, which may take several business days. Following approval, you’ll receive your merchant ID and other necessary credentials.

Expect to provide information related to your business’s legal structure, annual turnover, and the types of goods or services you sell. This information helps Sage Pay assess the risk associated with your business and determine appropriate processing fees and limits.

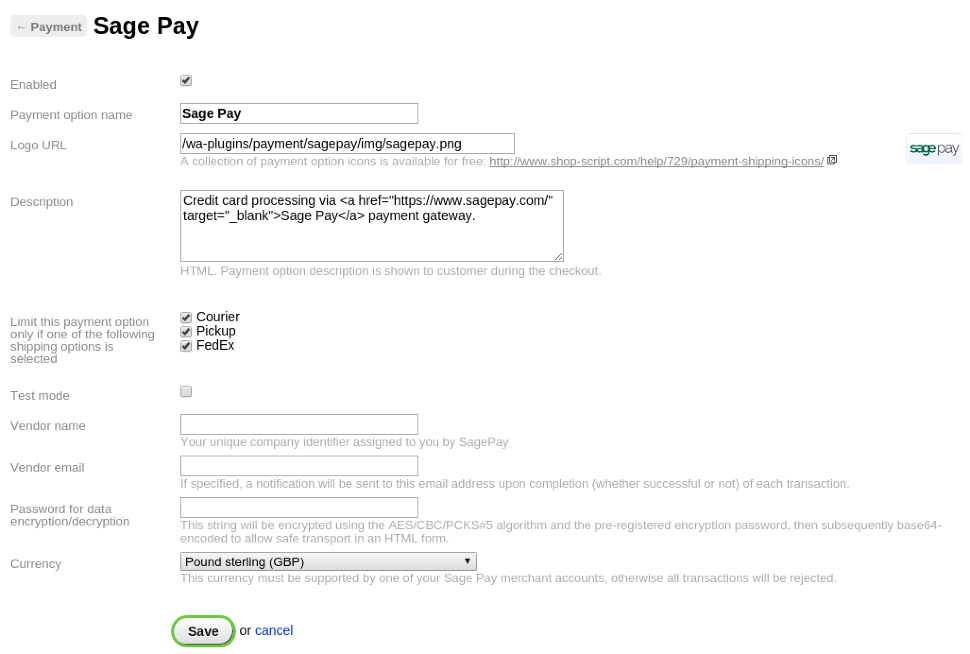

Configuration Options Available to Merchants

Once your account is approved, you’ll access a comprehensive control panel offering a wide range of configuration options. These settings allow you to tailor your payment gateway to your specific business needs and preferences. Key configuration options include setting transaction limits, defining supported payment methods (e.g., credit cards, debit cards, PayPal), customizing transaction notifications, and configuring security settings.

Managing Payment Gateway Settings and Preferences

The Sage Pay merchant control panel provides an intuitive interface for managing all aspects of your payment gateway. You can easily adjust transaction limits, enabling or disabling specific payment methods, and configuring email notifications for successful and failed transactions. Furthermore, the panel allows you to view transaction history, generate reports, and manage your account details. Regularly reviewing and updating these settings is vital for maintaining optimal performance and security.

For example, you might increase your transaction limits during peak seasons or adjust notification settings based on your team’s workflow.

Best Practices for Optimizing Payment Gateway Settings

Optimizing your Sage Pay settings involves a strategic approach to balancing security and user experience. Setting appropriate transaction limits prevents fraudulent activity while ensuring smooth processing for legitimate transactions. Regularly reviewing and updating your security settings, such as enabling 3D Secure authentication, is crucial for minimizing the risk of chargebacks and fraud. Furthermore, selecting appropriate payment methods based on your target audience and optimizing notification settings for timely updates enhance the overall efficiency of your payment processing.

For example, implementing automated email notifications for successful transactions can reduce customer inquiries. Conversely, timely notifications for failed transactions enable immediate customer support and potentially prevent lost sales.

Compliance and Regulations

Integrating Sage Pay Protocol v3.0 requires adherence to a robust framework of compliance regulations to ensure secure and legal processing of payments. Failure to comply can lead to significant financial penalties, reputational damage, and legal action. This section details the key compliance areas and best practices for maintaining a compliant payment processing system.

Relevant Industry Standards and Regulations

Several key industry standards and regulations govern payment processing, and adherence is crucial for using Sage Pay Protocol v3.0. These include Payment Card Industry Data Security Standard (PCI DSS), which dictates how sensitive cardholder data must be handled and protected. The General Data Protection Regulation (GDPR) in Europe, and similar data protection laws in other regions, govern the collection, processing, and storage of personal data, including customer information used in transactions.

Depending on your location and the types of transactions processed, you may also need to comply with other specific regulations, such as those related to anti-money laundering (AML) and know your customer (KYC) requirements. Understanding the specific regulations applicable to your business and location is paramount.

Data Protection Measures

Ensuring compliance with data protection laws like GDPR requires implementing strong security measures throughout your system. This includes employing robust encryption techniques for both data in transit and data at rest. Regular security assessments and penetration testing are vital to identify and address vulnerabilities. Implementing access control mechanisms to limit who can access sensitive data is also crucial.

Data minimization—only collecting and storing the data absolutely necessary—is a key principle. Finally, maintaining accurate records of all data processing activities and having a clear process for handling data breaches are essential components of a compliant system. Failure to implement these measures can result in significant fines and legal repercussions.

Compliance Certifications Relevant to Sage Pay Protocol v3.0

Achieving relevant compliance certifications demonstrates your commitment to security and regulatory adherence. While Sage Pay itself holds various certifications, your business should also aim for certifications relevant to your specific operations and the data you handle. PCI DSS certification is a fundamental requirement for any business processing card payments. ISO 27001 certification demonstrates a commitment to information security management.

Other certifications, depending on your location and business model, might include those related to data privacy (e.g., ISO 27701) or specific industry regulations. These certifications provide independent verification of your compliance efforts, building trust with customers and partners.

Final Review

Source: pimbrook.ie

Upgrading to SagePay Protocol v3.0 offers substantial benefits, from enhanced security to improved transaction management. While the integration process might seem daunting initially, following the steps Artikeld above, and utilizing the provided resources, will make the transition smoother. Remember to thoroughly test your integration before going live to ensure a seamless payment experience for your customers. Embrace the future of secure online payments with SagePay v3.0!

Frequently Asked Questions

What are the major security improvements in SagePay v3.0?

V3.0 boasts enhanced encryption, improved fraud prevention tools, and stricter data handling protocols, significantly reducing vulnerabilities compared to previous versions.

Is there backward compatibility with v2.0?

No, v3.0 is not backward compatible. A full update is required for optimal functionality and security.

What support is available during the integration process?

SagePay provides comprehensive documentation, API references, and often offers developer support channels to assist with integration issues.

How long does the upgrade process typically take?

The time required varies depending on your existing system’s complexity and your familiarity with the new protocol. Thorough testing is crucial and should be allocated sufficient time.